Flower Power - Seeds & Bitcoin

A Parable On The Genius Act

Flower Power

“Sunchokes get a fairly negative connotation because they are so vigorous and persistent and that sounds more like a positive to me.” Alexandra mused, as the Autumn afternoon drifted by in the Willamette Valley. “Besides they have such wonderful flowers late in the season; the power of flowers. I would venture to say.”

“Good heavens, Alexandra, you just stirred some wonderful memories for me and yes Sunchoke known also as Jerusalem Artichokes are actually great to grow. There is something peculiar or perhaps even perverse about being afraid of plants.”

“Memories about Sunchokes?” Alexandra asked.

“Not quite, it was your [power of flowers] comment which sparked the memory of the 1960’s and flower-power, for me. That is a life-style I lived vicariously in a Northern England town, at that time. As my current appearance belies, I was a Hippy back then, not aware of the power of seeds, as yet though. One great musical inspiration of mine was Jimi Hendrix. he was a true genius of the guitar.” At this point, Miguel looked starry eyed and reflective.

“Oh my, we are sparking each other today, I have been investigating the recent GENIUS Act here in the USA and I would like us to discuss it over afternoon tea if that is alright with you Miguel?” Ventured Alexandra.

“Afternoon tea indeed Alexandra, let’s brew some, let it steep and and we can meander off into some metaphorical weeds, as oft we jolly well do.”

The GENIUS Act

Tea now warmly sitting on their prized table, a discussion ensued between Alexandra and Miguel as late season bees flitted around Sunchoke flowers, nearby.

“There is actually a lot of speculation around the Stablecoin GENIUS Act passed recently by the USA and also how this may just be a way of the USA dealing with their $37 trillion US debt , I believe that Russia amplified this.” Started Alexandra.

“You’ve touched on a very interesting theory Alexandra (and one that’s gaining attention) — that the U.S. might use Stablecoin regulation (via the GENIUS Act) as a lever to help manage or alleviate its debt burden — and as you say, foreign actors (Russia, or its media/propaganda networks) might amplify that narrative. Let’s break it down a bit:

First, lets go over the key features & purposes of the GENIUS Act (U.S. Stablecoin regulation)-

It requires Stablecoin issuers to back their coins 1-for-1 with liquid assets like cash, U.S. Treasury bills, or equivalent (or very safe, low-risk instruments).

It subjects Stablecoin issuers to anti-money laundering (AML) / Bank Secrecy Act obligations.

It sets up a licensing / regulatory regime (state and federal) for “permitted payment Stablecoin issuers.”

It prohibits or restricts issuance in the U.S. by unauthorized or unlicensed Stablecoin issuers, and places constraints on foreign issuers (they must meet comparable regulation, hold reserves in U.S. institutions, etc.)

It prohibits or restricts issuance in the U.S. by unauthorized or unlicensed Stablecoin issuers, and places constraints on foreign issuers (they must meet comparable regulation, hold reserves in U.S. institutions, etc.)

It also aims to cement the U.S. dollar’s status as the world’s reserve currency in digital payments.

So, the idea that Stablecoin legislation could push more capital into U.S. Treasuries (i.e. increasing demand for U.S. debt) is not purely speculative — it is one of the stated intents.

In fact, some analysts have argued that as Stablecoin issuers grow, their demand for Treasuries (as reserve backing) could help reduce U.S. borrowing costs.” Miguel detailed.

“Thanks Miguel it is good to run through this again with you. It’s also quite ironic the US Treasuries can still be classed as very safe, low-risk instruments. Of course the Federal Reserve can just create value out of nothing, actually I will correct myself here; it’s not really value at all. Your grandchildren and their families will bear the consequences of all of this fiscal and monetary irresponsibility; sadly.” Responded Alexandra.

“Yes Alexandra and as we have said many times, thank goodness for Bitcoin and thank goodness for seeds; both true bastions of value. So let’s continue with the thread around the GENIUS Act and the current $37 trillion US debt; of course the real debt is far higher.

Intent in the legislation

As noted above, the Act’s authors openly state that it [will generate increased demand for U.S. debt]. We could stop right here, but lets dig a bit deeper.

Scale of Stablecoin issuers and their investment in Treasuries

If Stablecoin issuers become large players and hold sizable reserves in Treasuries, that could materially affect Treasury yields or demand dynamics. For example, a recent academic paper showed that Tether (one of the largest Stablecoin issuers) holds a substantial amount of U.S. Treasury bills, and changes in that share can influence short-term yields.

[Exorbitant privilege] argument

Some commentators suggest that stablecoins (especially dollar-pegged ones) could re-establish or deepen the [exorbitant privilege] (the U.S. advantage in issuing debt in its own currency). If many transactions globally shift to dollar stablecoins, global demand for dollar liquidity (and associated Treasuries) could rise.

Narrative incentives & geopolitical signaling

If foreign (especially adversarial) media or rhetoric suggests that the U.S. is effectively [laundering] or [repackaging] its debt through crypto, that can amplify distrust, sow discord, or push counter-narratives. For instance, there is reporting that a Russian advisor accused the U.S. of using a [Stablecoin scheme to eliminate $35 trillion debt.]”

“Thanks Miguel this helps a lot for me to crystalize some thoughts I have; do you mind if I discuss these with you?” asked Alexandra.

“Of course not and let’s not let our tea get too cold, it’s important to pay attention to real priorities.” Miguel winked at this point.

Alexandra continued:

“Magnitude / feasibility limits

Even if Stablecoin issuers demand Treasuries, they are unlikely to absorb anywhere close to tens of trillions in debt. The U.S. debt is on the order of $30–$40 trillion. The Stablecoin market today is much smaller (hundreds of billions, not tens of trillions). So the scale mismatch is huge.

Regulatory and market constraints

The Act constrains what can count as reserves (liquidity, safety, etc.). No Bitcoin, Gold nor seeds.

The Act doesn’t give unrestricted power to Stablecoin issuers — they must adhere to stringent compliance, audits, supervision, etc. This has me reflecting on [don’t trust verify]. I will continue though.

Also, Stablecoin issuers may face capital and liquidity constraints, competition, market confidence risks, etc.

Debt dynamics aren’t solved by demand alone

Even if Treasury yields go down or borrowing costs are partially subsidized, the underlying obligations (interest, principal, entitlement spending, deficits) still must be managed. Demand-side support doesn’t fundamentally reduce the need for fiscal discipline, revenue, or structural policy.

Uncertainty & timing

The GENIUS Act is new; its real-world effects will take time to manifest.

Market behavior, global competition, alternative stablecoins, regulatory responses abroad, etc., all can counterbalance U.S. ambitions.”

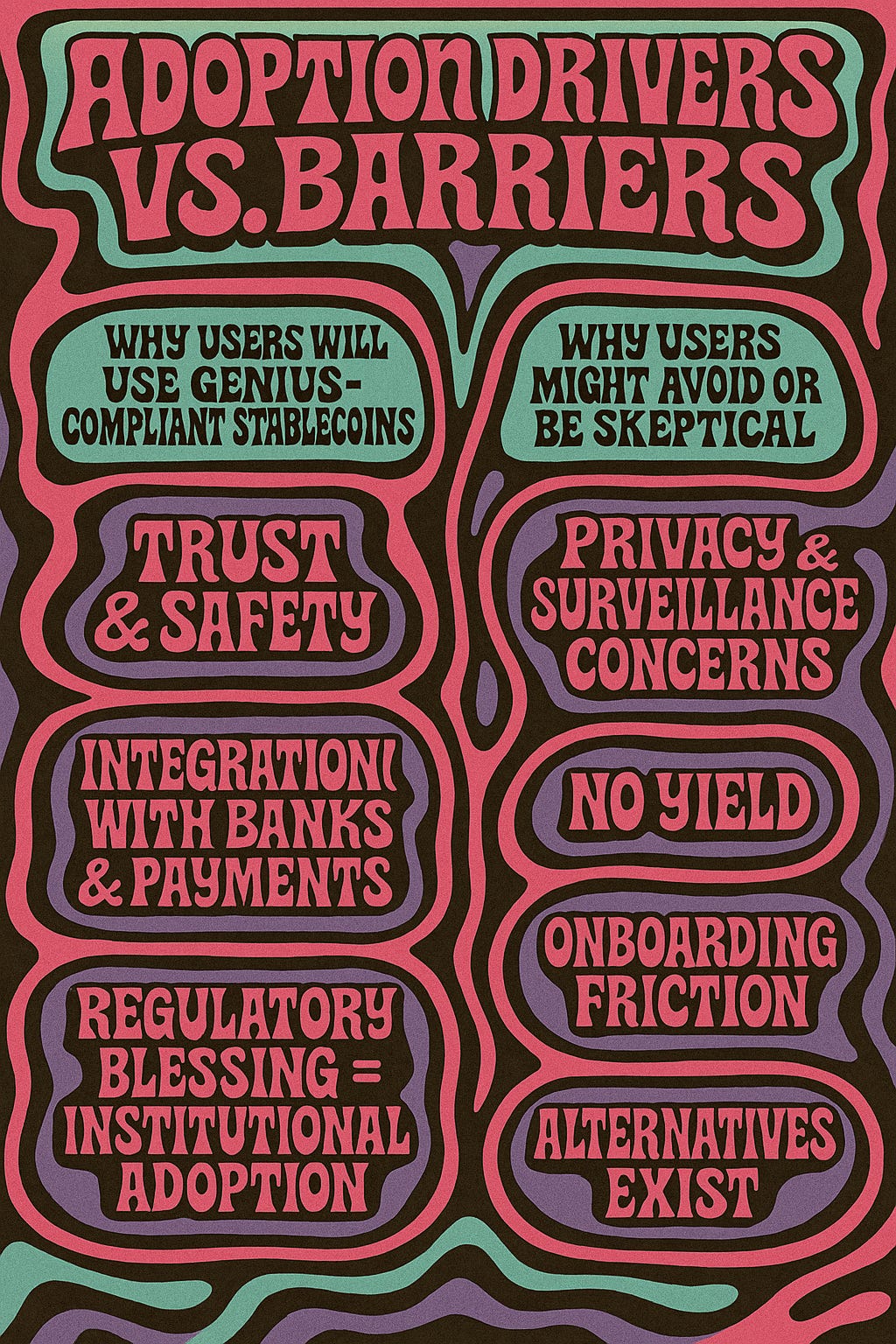

“Wow, thanks so much for these very cogent points Alexandra, we are both digging deeply into the weeds here. Of course we don’t actually recognize that there are weeds at all.” Joked Miguel and they both chuckled at this point. “Besides, how do we know that any consumers will use these new Stablecoins? In fact I created a little design for you about this, from my days in the happy-hippy times of the 60’s. Can I show this to you?”

“Of course Miguel” responded Alexandra. At this point, Miguel reached into his trusty satchel to pull out a painting.

“Oh my that is a wonderful piece of art you created Miguel, it looks sort of dreamy in fact”.

“We used to call this style Psychedelic in fact and yes it was sort of trippy, thinking about it and a good deal of the music at that time certainly was. However the current US debt situation is the most trippy time of my 77 years on this planet!”

“Time for some more tea, tea-time-in-the-times of tumult?” Ventured Alexandra.

“Ah that was very perfectly pertinent prose, a literal expounding of alliterations and yes let’s get some more tea, for certain. This is a long conversation yet one which is important at this time, because the GENIUS Act is really the first time that the US Government has got pretty serious about the cryptocurrency world or [crypto] as the colloquialism goes. So this is a good time to really dig in to the implications of it all.”

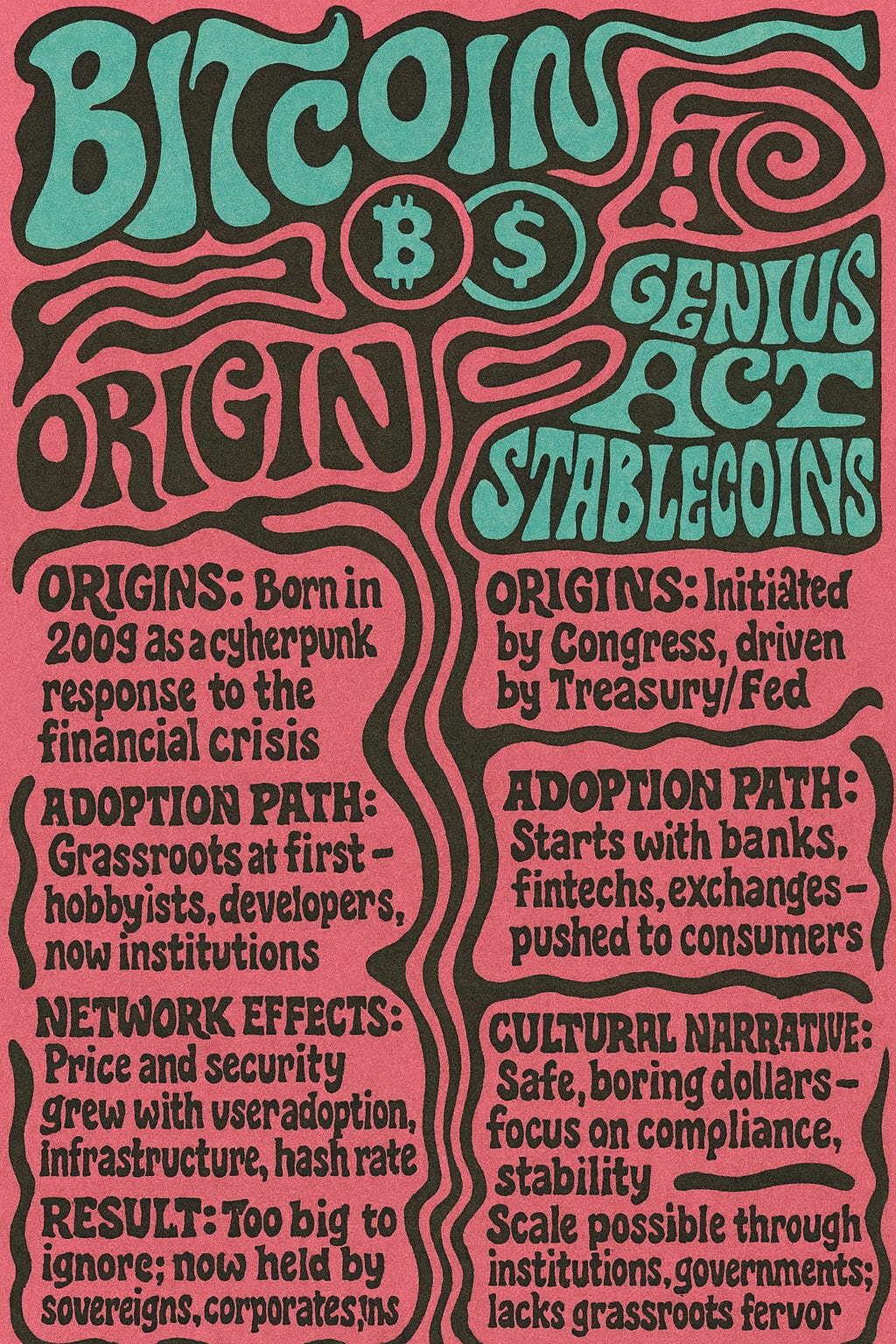

“Yes Miguel and of course Bitcoin is completely different to what the media has dubbed [crypto] and yet so very few people have absorbed this fact as yet. Your interviews with Tiara Teal really dug into this so very well, I believe.” Alexandra poured more boiling water into the teapot as the afternoon conversations ensued.

“One other reflection here is that as Stablecoins are largely pegged to the US Dollar they suffer from the same ongoing devaluations via inflation. To be honest I never fully understood why the name Stablecoin emerged in the first place.” Posited Miguel.

“Yes Miguel you are absolutely right — and this is a key point that doesn’t get enough attention in the hype around stablecoins.

Most popular Stablecoins (USDT, USDC, DAI [and now possibly USA₮ from Tether] under the GENIUS Act) are pegged to the U.S. dollar and fully (or over-) collateralized in USD cash, cash equivalents, or Treasuries. This peg means:

They track the dollar’s purchasing power — if $1 buys less over time, so does 1 Stablecoin.

They’re not a hedge against inflation — unlike Bitcoin (fixed supply) or gold (scarce asset), Stablecoins are designed to remain $1 no matter what happens to CPI or the money supply.

They are useful for price stability and transaction convenience but not for long-term store-of-value purposes if inflation is a concern and inflation should always be a concern.

Another curious evolution of financial systems over time, is the Eurodollar system which we discussed previously. So perhaps the evolution of US Dollar Stablecoins, globally was related to the Eurodollar system?” Wondered Alexandra.

“Yes Alexandra I think that is a key point and some in the crypto and DeFi space have been exploring ways to create [inflation-protected Stablecoins] or [flatcoins], which aim to track purchasing power (CPI baskets, energy costs, etc.) rather than nominal USD.

Examples: Ampleforth, Frax’s [FXS flatcoin proposal,] and Coinbase’s [Flatcoin R&D.]

Challenge: Measuring real-time inflation credibly, trustlessly, and in a way that can be enforced on-chain is hard, and CPI itself is politicized.”

“Oh, I had not heard of Flatcoins Miguel, can you expand on this please.”

“Yes of course Alexandra, as best I understand it, a Flatcoin is a type of stable-value cryptocurrency designed to track purchasing power, rather than a fixed nominal unit like the U.S. dollar.

Stablecoins (USDT, USDC, etc.): Pegged to fiat currency (usually USD). They are stable in nominal terms, but exposed to inflation.

Flatcoins: Pegged to a basket of goods or an inflation index (like CPI), so their value is meant to remain flat in real terms (purchasing power).

The goal is to create a digital asset that protects holders against inflation while still providing stability compared to highly volatile crypto like BTC/ETH.

In short: Flatcoins are [Stablecoins for the long game] — attempting to preserve what a dollar buys, not just what a dollar is. But they are still mostly experimental compared to the massive adoption of USD-pegged stablecoins.” Answered Miguel.

“Thank you Miguel, this sounds to me like yet another possible confusion for people who may well just prefer the perceived simplicity of Fiat-based systems. This is hard for me to say as I am certainly not anti-technology in any sense. But they almost look like a solution in search of an imagined problem?” Mused Alexandra.

“There is no shortage of creativity in the world of money these days. From Bitcoin’s grassroots rebellion to the GENIUS Act’s top-down Stablecoin framework, we seem to be swimming in new monetary experiments. Somewhere in the middle of this spectrum sits the Flatcoin: a proposed cryptocurrency that promises to remain [flat] in real terms, tracking purchasing power instead of a fiat peg like the dollar.

On paper, the idea sounds compelling. Unlike USD-pegged stablecoins, which quietly leak value over time through inflation, a Flatcoin would keep you even. One token today should buy you the same basket of goods tomorrow. In theory, this could be a gift to savers in places where inflation eats through wages at double-digit rates. For futurists, the elegance of money that does not decay is hard to ignore.” Reflected Miguel.

“But is this innovation or illusion, Miguel?” asked Alexandra.

“The reality is more complicated. Flatcoins rely on inflation indices, usually government statistics such as the CPI. These are lagging, politicized, and often mistrusted. They also introduce a layer of technical complexity and possible security risk: oracles, smart contracts, rebasing mechanisms. Most people already struggle to understand what a Stablecoin is. Asking them to trust a CPI-linked algorithm may simply be a bridge too far.

There is also the matter of network effects. Stablecoins are liquid, widely integrated, and increasingly regulated into legitimacy. Bitcoin has become the default hedge for those who reject fiat inflation. Flatcoins are left in the middle — not as stable as dollars, not as conviction-driven as Bitcoin, not as familiar as cash.” Alexandra thought, aloud.

“Very good points, Alexandra.” responded Miguel. “That does not mean the experiment should be dismissed entirely. History teaches us that monetary forms evolve unpredictably. Perhaps Flatcoins will find their niche in high-inflation economies, or as an intellectual stepping stone to new models of value. But for now, they remain more of a thought experiment than a monetary revolution.

Oh and I almost forgot, I have one more poster-style painting I created to share with you.” Here Miguel reached into his satchel once more.

“My thoughts on Bitcoin’s and the GENIUS Act’s evolution.”

“Tremendous again Miguel and thank you so much for our wonderful afternoon tea-time today.”

The tea turned out to be a great inspiration for Alexandra and Miguel as often is the case.

Thank you as always for following the ongoing exploits of Alexandra and Miguel.