Fools Rush In or Hubris Before Nemesis

Facing Up To Real-World Datacentre Challenges Needs To Be A First-Step

It’s Tea Time (Always)

The kettle rattled as water bubbled toward a welcome boil, it was just before dawn and the moon glinted cool-ly off the battered, well-worn old friend, Miguel’s trusty kettle. He hunched over his corner desk and day-dreamed about the rapidly unfolding rush to win the so-called “AI battle”. He thought aloud “Why is everything so ludicrously competitive and filled with such negative adrenalin rushes?”

He was startled out of his thoughts by a rap on his slightly opened door. “That’s a good question, which we have asked many times, in one way or another” replied Alexandra, even though the question was addressed to the air, rather than to her, directly.

Data Centre Dichotomy & Power Needs

“Oops you caught me talking to myself; again” responded Miguel with a half embarrassed grin. “Yet. here is a really ironic part in all of this, there is almost a "feeding frenzy" for investment into AI, data-centres etc and I know this is very important, but at the same time, climate-change concerns have been cast-aside, along with practicalities for power grid operations.“

“Yes Miguel and in my opinion that is a really grave mistake, as we are already beginning to see. Ironically, climate change effects will probably make it increasingly more difficult to build out these AI driven data centres. We are even seeing quite a number of Bitcoin mining operations crossing over to support AI build-outs and we can understand why they might feel that way, however I think it could a mistake to completely relinquish Bitcoin [mining] in favor of AI.” Posited Alexandra.

“We’ll get back to the AI-Bitcoin-mining thoughts, shortly. In addition, after almost 40 years working on tech project [plumbing] I know that simply throwing money and hardware at challenges rarely produces the best results. For instance, where the heck are we going to get all the electrical power needed? It's almost like [build the data centres and the energy will appear!] In reality almost every company involved in the energy sectors are nowhere near capable of keeping up with demands. As an example, if you have a shower fed by a 3/4” pipe from your attic, adding a water-tank that is twice as big won’t increase the water-flow in your showerhead because the pipe is still 3/4”. So additionally, then you add a second tank to the same pipe, the result is the same, no increase in flow at the showerhead.” Spluttered Miguel, well almost spluttered as he was getting a little animated (little being the operative word).

“This is a really good article on some of the challenges faced here, Alexandra”.

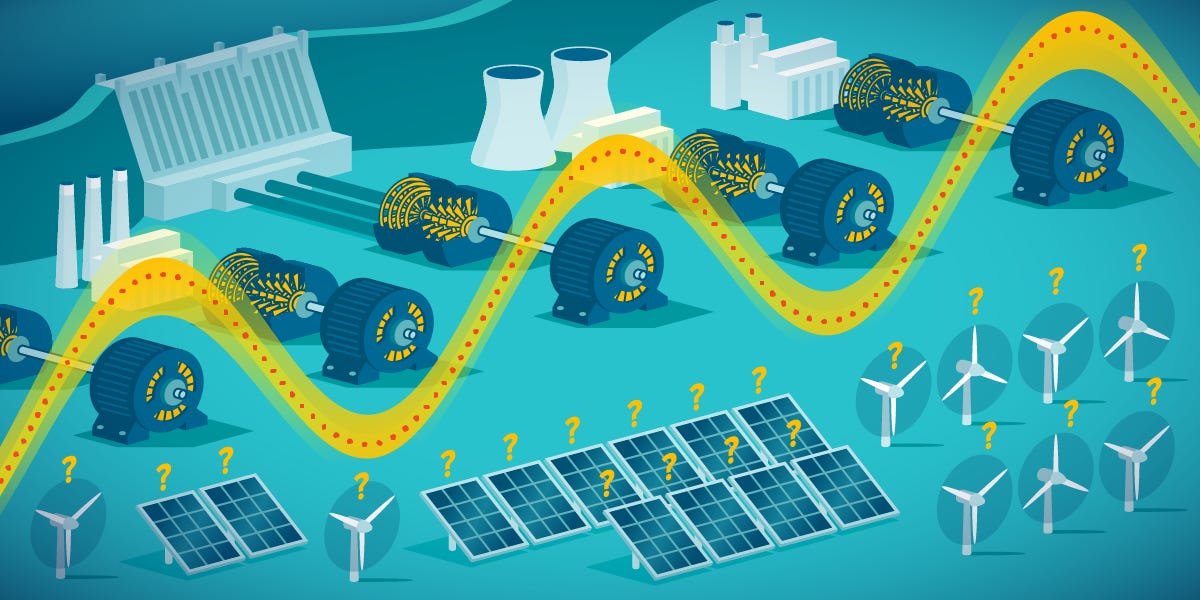

[Turbines, generators, and motors in fossil, nuclear, and hydro power plants spin at speeds proportional to grid frequency. The rotational energy of these massive devices provides significant inertia that can counteract changes in grid frequency due to disturbances.]

Monetary Mania’s

“Thank you Miguel, could it be that the seemingly insatiable pursuit for more wealth answers some of your thinking out loud from before. [Why is everything so ludicrously competitive and filled with such negative adrenalin rushes?] After all, aren’t corporations in the USA compelled by law to deliver profits to investors?” Asked Alexandra.

Miguel replied, “there are certainly some implied truths in this widely held belief, however, Alexandra, here are some nuances:

Publicly traded corporations (and even many private ones) are typically structured with a fiduciary duty to their shareholders.

This means directors and officers are legally obligated to act in the best interest of the shareholders.

In practice, this is usually interpreted to mean maximizing shareholder value — most commonly understood as profit.

So yes, there is legal pressure to prioritize profits, especially in the corporate governance structure. However:

There is no law that explicitly states: “Corporations must maximize profits at all costs.”

Courts have recognized that long-term value and even ethical considerations can be part of directors’ judgment.

Case law (e.g., Dodge v. Ford Motor Co. in 1919) has been cited as reinforcing profit-maximization, but more recent interpretations give boards some discretion.

Benefit corporations (B Corps) and other models legally allow — or require — directors to consider other stakeholders, like workers, the environment, or local communities.

Having said this, I believe hubris most certainly plays a huge part in such overall initiatives like those driving us hells-bells into constructing data-centres to build out US AI capabilities. And as Greek literature showed, several times, Hubris precedes Nemesis.”

By this time, Alexandra and Miguel were heading down to their solar-punk styled greenhouse, striding through the lighted dewed dawn passed swales with berms on which grew berry bushes.

Hubris Precedes Nemesis

“Hubris precedes Nemesis” repeated Alexandra, “That sounds very apt and one additional point in all of this is hypocrisy. So many railed against Bitcoin and the energy used in [mining]. Now, potential energy use has gone out of the window as a discussion point when it applies to AI, as have discussions of environmental impacts of these data-centre build-outs, as we mentioned before.”

“Ah yes Alexandra and those unfair and unfounded criticisms still have impact today, in fact. Let’s address another point you made earlier about Bitcoin [miners] leaving to support AI build-outs. In my opinion, both camps could benefit from working together.

Despite their differences, the two can coexist synergistically in ways that optimize energy, revenue, and hardware utilization:

1. Energy Load Balancing

Bitcoin mining can act as a flexible interruptible load, making it ideal for absorbing surplus energy.

When AI systems need to ramp up, mining can scale down instantly to free up power.

This helps stabilize microgrids and optimize energy use in remote or renewable-rich areas.

2. Revenue Smoothing for Data Centers

AI inference/training workloads cost money to run. If a data center has unused capacity or off-peak periods, mining can generate income from idle electricity.

This is especially compelling for hyperscale operators or solarpunk-style community centers seeking financial resilience.

3. Hardware Infrastructure Separation with Shared Cooling & Power

Mining rigs (ASICs) and AI servers (GPUs) can coexist in separate thermal zones sharing common infrastructure:

Liquid or immersion cooling loops

Heat recapture systems (for greenhouses, aquaponics, etc.)

On-site renewable + battery + generator backup

4. Proof-of-Useful-Work Experiments

Some researchers are trying to merge the models: can AI computations be used as “proof-of-work”?

While controversial and technically challenging, Proof-of-Useful-Work could:

Redirect Bitcoin-like mining energy into AI tasks

Solve real-world problems (e.g., protein folding, simulations)

What do you think, Alexandra?” Asked Miguel.

“The points you raised are key of course” responded Alexandra “And there is the revenue model. The revue to Bitcoin [mining] seems more direct to me, because Bitcoin mining has a direct revenue model, and that’s one of its major advantages over AI operations — especially when we consider long-term sustainability and decentralization.

1. Built-In Monetization

Bitcoin miners receive:

Block rewards (currently 3.125 BTC per block as of the 2024 halving)

Transaction fees from users

This is automated, programmatic, and permissionless — no customer acquisition or third-party billing needed.

2. Global Market, Local Execution

Mining BTC produces an asset with instant global liquidity.

If Bitcoin is rising in fiat terms, your mining revenue is rising too — with no need to sell a service or product.

3. Real-Time, Irrefutable Payment

Block rewards and fees are paid on-chain — no payment processors, subscriptions, or late invoices.

That makes mining more deterministic than running AI models for clients.”

Sound Synergies

By now they had reached the greenhouse door, “Oh this magical space we have Miguel” sighed Alexandra. “You make some great points indeed and in so many ways, this is still all unfolding. As we discussed already, the current-basic grid-level infrastructure more or less certainly cannot support the data-centre build-outs planned and that will become evident pretty quickly. Underneath this all both AI and Bitcoin activities do have synergistic possibilities considering that both rely on ASICS (Application-Specific Integrated Circuits) for maximum efficiency, at least for now. And then we have The Intelligent Internet emerging, as we discussed in this conversation. Let’s just keep observing, talking, thinking and executing, like we have done already via our greenhouses, and solar-punk architecture which makes this especially exciting:

Off-grid microgrids could prioritize community-serving AI (weather prediction, language translation, medical support), paid for in part by mining BTC when demand is low.

Thermal synergy: Mining heat can be piped into aquaponic tanks, drying herbs, warming soil beds, or fermenting seeds.

Resilient infrastructure: Bitcoin mining brings capital in; AI serves people. Together, they build closed-loop cycles of finance and benefit.

“In we go” Alexandra exclaimed, excitedly. “There is is much to explore and discover, Miguel.”

Thanks for reading as always.